With the year fast approaching the end of 2023 .... things are traditionally starting to crawl in the market as investors start to wind down for holidays and strategise for the upcoming new year. It has also been the first full year of my sabbatical without employement income. While clocking my 6-figures investment target (YTD $121K), it is still lower than my previous income of job+cpf, minus the long hours of company politics/meetings/travelling etc. Well I guess in life, there's always a Give and Take. As the saying goes ... Nothing in life is Free... Everything has its Price

The month of Nov profits came mainly from DBS, bonds and a small position in SIA Engineering. Have always enjoyed flying in SIA planes since young, plus Singapore's aspirations to vie as an aviation hub, so this smallish position should be okay 😎 Nimbled a bit more on UOB, which is making into my Top stock position. Bought some SSB/Tbills and participated in the DRP of MLT. So basically that sums up my Nov activities hahaha ...

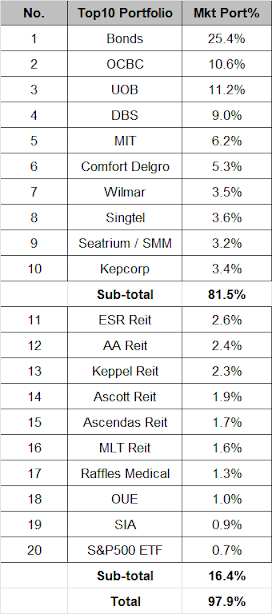

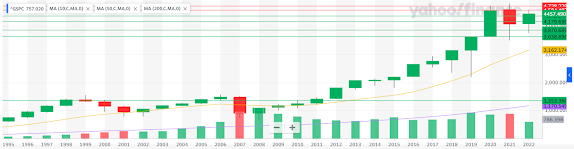

Finally tabulated my Top20 positions which makes up 98% of my portfolio. Bonds and Banks form the major bulk, with common household blue chips and Reits. Started dabbling with S&P500 ETF (VUSD.L and IVV.US) and Nov month has been a good recovery for S&P500 index. USA market has always been much more lucrative than the "boring" Singapore market. If I need more money, I will invest into USA stocks 😂

As always, if u have any comments or suggestions, please feel free to comment below

Related Posts: