Over the past few months, I have been rebalancing & streamlining my portfolio to make it easier to manage for the future. I have fully divested Sembcorp Industries and Yangzijiang, and will be looking to sell away my small holding of ST Engineering in the near future.

Diversification is a risk management strategy to create different investment assets within a portfolio. With every strategy comes its pros and cons. While attempting to reduce risk through different baskets of equities, more time would also be needed to analyze and manage the risks within each investment. As I am looking to increase my holdings in S&P500 ETFs (IVV.US and VUSD.L) for the longer term, it only makes sense to reduce my time in other non-critical Singapore stocks.

I have in the past avoided investing in USA stock market (besides Employee Stock Purchase Plans) due to the time difference, taxes and more importantly in the event of sudden death. It would be confusing for my spouse or immediate family to liquidate the USA holdings coupled with Singapore estate assets during times of grieve. Since I have slightly more time now and with USA still being the most investible market in the next few decades, it makes sense to dabble once again with tiny steps into passive ETFs.

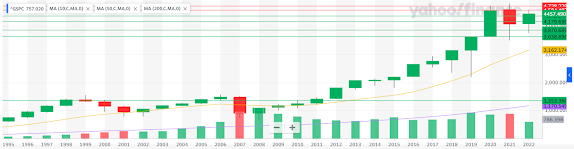

The S&P500 index has really had an explosive run since 1950s. With the exception of 8-years period from 2000 to 2008 (Dotcom and Global Financial Crisis). With the 2020 Covid crash behind us, and USA markets recovering to push towards new all time highs, will it go even higher or revert back to a double top 8-years period repeat? Let me know your thoughts in the Comments section below 😎

In the short term chart, price support would be in 4370 levels, while price resistance would be in 4580 levels. Would hope to pick up some if prices retrace to around 4370, as USA economy seems to be heading for a soft landing. Inflation is coming down slowly but surely, and labour market is reasonably strong. If the economy weakens in 2024, the Fed would have more options to reduce interest rates and print more money, which bodes well for the USA stock market. While long term it might not be the best choice for the country, but it does turbo boost the market prices from the 2009 GFC recovery. Cheap money always finds the place where it is treated best, and good investors would have little choice but to ride the bull run so as to protect their personal wealth. Buying the Top500 companies would be buying into the near future of USA, and my personal conviction is that USA would remain the strongest and most investible market in the next decade.

Are you also looking to buy into the S&P500? Let me know too 😅

Related Posts:

Morning...Since last year, I have also participated in the US mkt thru endowus platform. Passive investing thru DCA monthly. Though I am not a big fan of DCA, i guess it will kind of work in markets that we think will go up in the long term (min 10-20yrs). History has shown that US mkt really goes up in the long term despite major corrections along the way. So I am not going to crack my head over this. My result after 1 yr...its about 9% up currently.

ReplyDeleteAgree about long term US market and its strength relative to other major global economies. History has shown itself over the past few decades. Let's hope that history will repeat itself and we will all profit from it :)

DeleteHi Simple Investor, why don't u invest directly in an S&P ETF (IVV or VOO), and save on the 0.6% endowus fees?

DeleteHi, because I am using CPF OA funds to DCA into S&P. I think only endowus allows this. If using cash, there are more options and VOO may be is a better choice. Cash more for active investing in my case.

Deleteah... okay understand... that explains about using endowus for cpf. My CPF OA is used only to purchase Singapore Tbills. For cash, I am also investing in Ireland domicle S&P500 etf like VUSD.L

DeleteGreat choice too. Using cash, i read that QQQ is also another gd option. More volatile but if can stomach the volatility, over 10-20yrs, shd perform even better than S&P. Cash really do hv much more options. I am now thinking to go into Japan mkt thru etf. My thesis is very simple, sleeping giant awakes...

DeleteQQQ technology stocks have run up quite a bit, so I will monitor further, plus QQQ expanse ratio is also much higher... Japan has a shrinking population and high debt/deflationary environment, might struggle in the long term

DeleteJust my 2 cents - All things go south if Trump wins election. US had the long term trend because of its institutions and due processes which not not ideal were still better than most of the world from a commercial perspective.

ReplyDeleteThanks abc for your comments. My guess is Trump is unlikely to win again *fingers crossed*

Delete